texas estate tax rate

While Texas doesnt have an estate tax the federal government does. Learn about Texas property taxes 4CCCE3C8-C54F.

Harris County Tx Property Tax Calculator Smartasset

There are no inheritance or estate taxes in Texas.

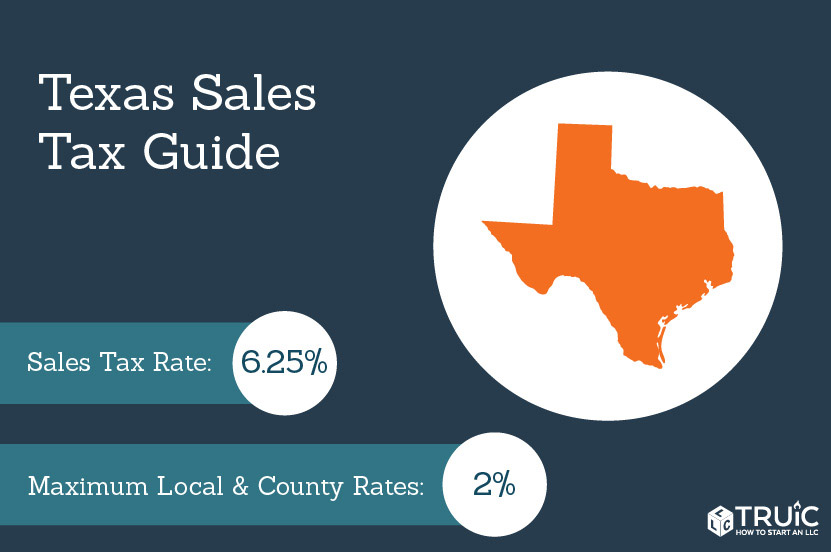

. High Texas property tax rates may mean seniors on a fixed income are taxed out of their homes dont forget Home Tax Solutions can help. The budgets adopted by taxing units and the tax rates they set to fund those budgets play a significant role in determining the amount of taxes each. The Texas state sales tax rate is 625 and the average TX sales tax after local surtaxes is 805.

Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate. We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the. Real Estate Tax Rate.

Evaluations must be at whole market value except for capped residential homestead properties. This is currently the seventh-highest rate in the United States. Groceries prescription drugs and non-prescription drugs are exempt from the Texas.

The estate tax sometimes also called the death tax is a tax thats levied on the transfer of a deceased persons assets. Tax exemptions such as the. This data is based on a 5-year study of median property tax rates.

No estate tax or inheritance tax. The Citys property tax rate on real property is 0763323 per 100 of assessed value. The average property tax rate in Texas is 180.

By Jonas November 20 2021 4min read 1276 views. Property Tax Transparency in Texas. Overall TTARAs analysts write property tax bills in 2021 totaled 73 billion but would have totaled 79 billion without the 2019 changes in the law.

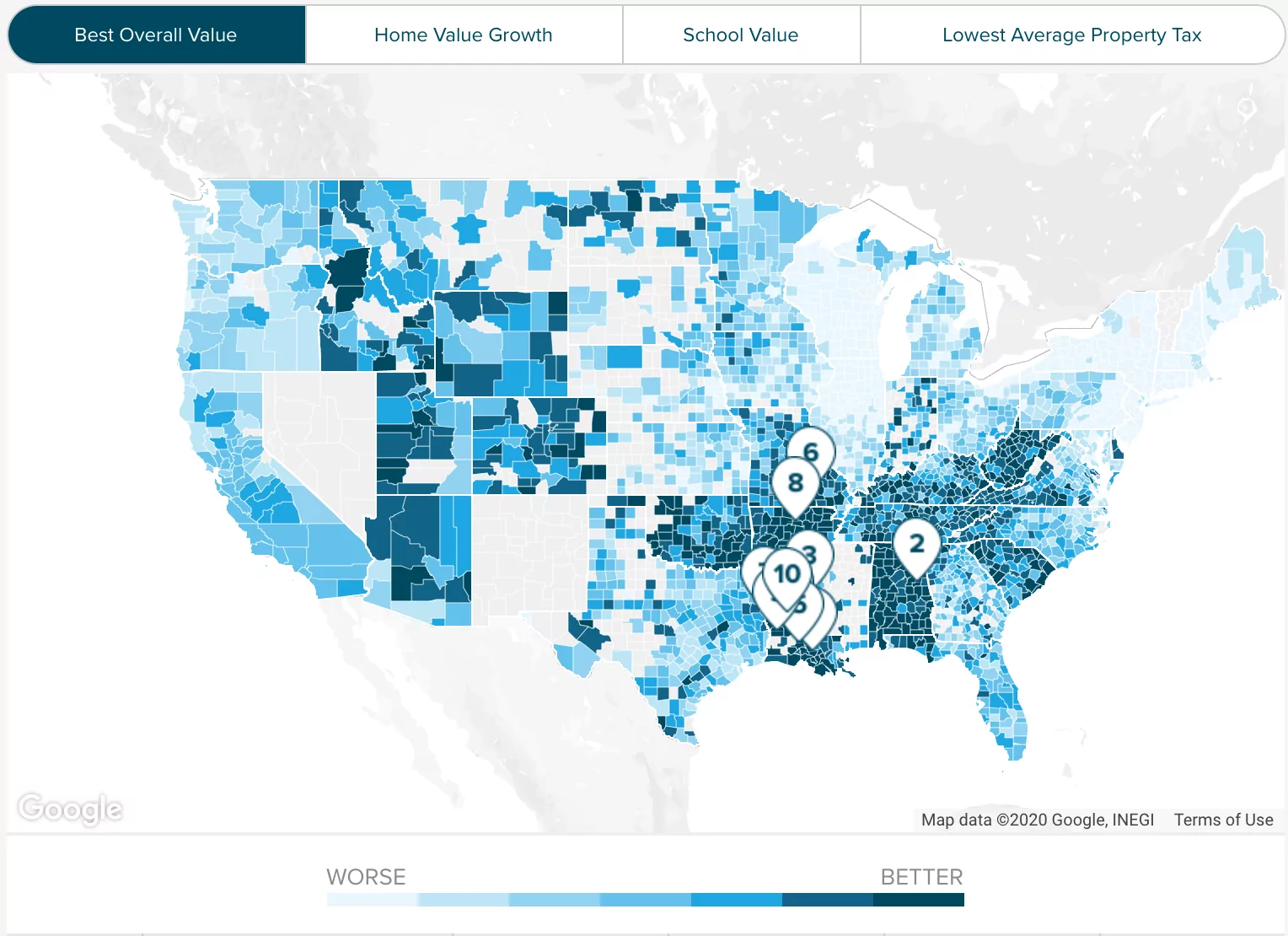

Texas is home to one of the highest property tax rates in the country according to a recent study from WalletHub. No estate tax or inheritance tax. That said you will likely have to file some taxes on.

2020 rates included for use while preparing your income tax deduction. To find detailed property tax statistics for any county in Texas click the countys name in the data table above. In each case these rates are calculated by dividing the total amount of taxes by the current taxable value with adjustments as required by state law.

This means that any estates that are valued over 117 million dollars will be taxed before any assets are. The state repealed the inheritance tax beginning on Sept. On these homestead appraised values increases cannot exceed ten percent yearly.

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services. Texas has some of the highest property taxes in the entire country. Rates include state county and city taxes.

State Summary Tax Assessors. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Counties in Texas collect an average of 181 of a propertys assesed fair.

Property taxes in Texas are the seventh highest in the United States with. In 2022 the federal estate tax ranges from rates of. The rates are given per 100 of.

The top estate tax rate is 16 percent exemption. Here is a list of states in order of lowest ranking property tax to highest. They range from the county to Conroe school district and more special purpose entities such as water treatment plants water parks and transportation facilities.

Texas has 254 counties with median property taxes ranging from a high of 506600 in King County to a low of 28500 in. Texas Property Taxes Overview in 2022. Call Today For Your Free Quote 800 688.

Property taxes in Texas are calculated based on the county you live in. However Texas residents still must adhere to federal estate tax guidelines. Texas has seventh-highest property tax rate in US.

Texas does not have a state estate tax or inheritance tax. No estate tax or inheritance tax. The latest sales tax rates for cities in Texas TX state.

While for the most part the national average as far as property taxes go sits around 12 its upwards of. In other words the owner of a 100000 home would pay the City 76333 in property taxes.

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Talking Taxes Estate Tax Texas Agriculture Law

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas State Taxes Forbes Advisor

Texas Retirement Tax Friendliness Smartasset

Why Are Texas Property Taxes So High Home Tax Solutions

How Do State And Local Individual Income Taxes Work Tax Policy Center

Sales And Use Tax Rates Houston Org

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Texas Sales Tax Small Business Guide Truic

How Do State And Local Sales Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

What Is The Property Tax Rate In Southlake Texas Property Tax Southlake Southlake Texas

States With No Estate Tax Or Inheritance Tax Plan Where You Die