wells fargo class action lawsuit payout

The bank estimates up to 35 million accounts were created between. 2 the 500 Additional Compensation payments to the Statutory Subclass Members.

Keller Rohrback L L P Wells Fargo Agrees To Pay 110 Million To Resolve Consumers Class Action Lawsuit About Unauthorized Accounts Keller Rohrback

3 the Fee and Expense Awards to Class Counsel approved by the Court.

. Class Action Settlements. The company has since apologized and resolved the cases. The settlement includes 500 million in investors money.

The settlement in the Wells Fargo unwanted auto insurance lawsuit has been preliminarily approved by the Court and the settlement checks are being mailed out to eligible customers. Wells Fargo will establish a settlement fund Settlement Fund totaling 4500000000 to pay. The final approval of a 28 million CIPA settlement agreement between Wells Fargo and its customers has been.

Wells Fargo CIPA Settlement 2021 28 Million To Businesses Whose Calls Were Recorded Without Consent By Consider The Consumer on January 10 2022. The Class includes all businesses that received a phone call from a call center operated by International Payment Services LLC or one of its affiliates between March 7 2011 and May. Wells Fargo Settlement Call Recording Claims Claim Form.

Wells Fargo will pay 500 million to end a class action lawsuit refunding US. Feb 23 Reuters - Wells Fargo Co was hit with a proposed class action lawsuit on Wednesday accusing the bank of routinely requiring hourly. Wells Fargo CIPA Settlement Receives Final Approval.

The settlement requires Wells Fargo to compensate eligible. Wells Fargo Settlement Call Recording Claims Class Action Lawsuit. Nearly 36 million will be paid out to borrower attorney fees and 500000 will cover attorney expenses.

Welcome to the Informational Website for the Wells Fargo CPI Class Action Settlement. Let Top Class Actions know when you receive a check in the comments section below or on our Facebook page. 1 the Approved Claims for GAP Refunds to the Non-Statutory Subclass Members.

Under the terms of the settlement agreement Class Members will be automatically entered into the settlement and receive a share of 13575 million. The suit was filed in May 2015. District Court judge in northern California approved another 142 million class-action settlement in late May for victims of Wells Fargos fake accounts scandal.

The lawsuit also alleges that Wells Fargo knew of the error. PDF Defendants are distributing at least 3935 million to Class Members pursuant to an Allocation Plan. For the 394 million settlement Wells Fargo is estimated to pay 385 million and National Guard will cover the remaining 75million.

Wells Fargo Loan Modification Error Caused By Wells Fargos Negligence. Lead plaintiff Armando Herrera had alleged Wells Fargo collected the entire amount of the loan including the cost of the GAP insurance coverage. Settlement Agreement Main Document Document 262-1 PDF Settlement Agreement Exhibit A - Definitions Document 262-2 PDF Settlement Agreement Exhibit B - Settlement Allocation Plan Document 262-3 PDF Settlement Agreement Exhibit C - Settlement Distribution Plan Document 262-4 PDF Class Action Complaint.

The settlement benefits individuals who had a credit card account direct auto account home equity line of credit account or personal line account with Wells Fargo that was charged off meaning the grantor wrote. Negotiations have been hard according to the customers requesting approval for the class action settlement. According to the complaint the banks executives violated consumer rights by making misleading statements and failing to disclose material facts to increase sales.

Those employees many of whom were unionized suffered the consequences. The financial corporation has found itself facing consumer backlash regarding alleged unfair operations of the bank potential unethical practices and more which have resulted in a range of class action lawsuits being filed. And 4 any Service Awards to the Class.

A Wells Fargo class action lawsuit was filed in June 2016 in response to the banks actions in the financial industry. Wells Fargo will pay 3 million as part of a settlement resolving a class action lawsuit that claimed the bank mishandled bankruptcy credit reporting. Settlement checks were mailed to eligible Original Class Members on December 7 2020.

The Court has scheduled a. The Wells Fargo lawsuit resolves claims of fraudulent activities involving unauthorized accounts forged signatures and unauthorized services. The class action lawsuit we filed alleges that Wells Fargo failed to implement and maintain the proper software and protocols to correctly determine whether a mortgage modification was required under federal regulations.

A settlement deal with the Financial Industry Regulatory Authority has settled class action claims made by Wells Fargo. Ultimately Wells Fargo denied the class action lawsuits allegations but agreed to pay 185 million to settle the dispute. IF WELLS FARGO SENT YOU A LETTER STATING THAT IT MISTAKENLY DENIED YOU A LOAN MODIFICATION AND YOU LATER LOST YOUR HOME TO FORECLOSURE YOU COULD GET A PAYMENT FROM A CLASS ACTION SETTLEMENT.

Consumers who paid off their car loans early and paid what they say were improper GAP insurance fees. Wells Fargo Cuts Overdraft Fees After Settling a Class-Action Lawsuit By Jennifer Farrington. The bank has agreed to pay 185 million to resolve the allegations.

The company has agreed to pay 3 billion to resolve the claims. 1 day agoLOS ANGELES March 19 2022 PRNewswire -- Ellis George Cipollone OBrien Annaguey LLP has filed a complaint on behalf of an individual plaintiff and a class action against Wells Fargo Bank NA. 13 2022 Published 237 pm.

The lawsuit looks to cover all African American consumers who applied for credit related to residential real estate and who were allegedly subjected to discrimination by Wells Fargo due to their race. The Wells Fargo lawsuit filings follow claims of the bank unfairly repossessing property customers receiving mortgage forbearances they didnt ask for. The Court granted final approval to this class action settlement Nov.

The process is expected to take until early 2020 as there are hundreds of thousands of eligible class members to compensate. Consumers who paid off their car loans early and were allegedly subject to improper Wells Fargo GAP or guaranteed auto protection insurance fees may be eligible to.

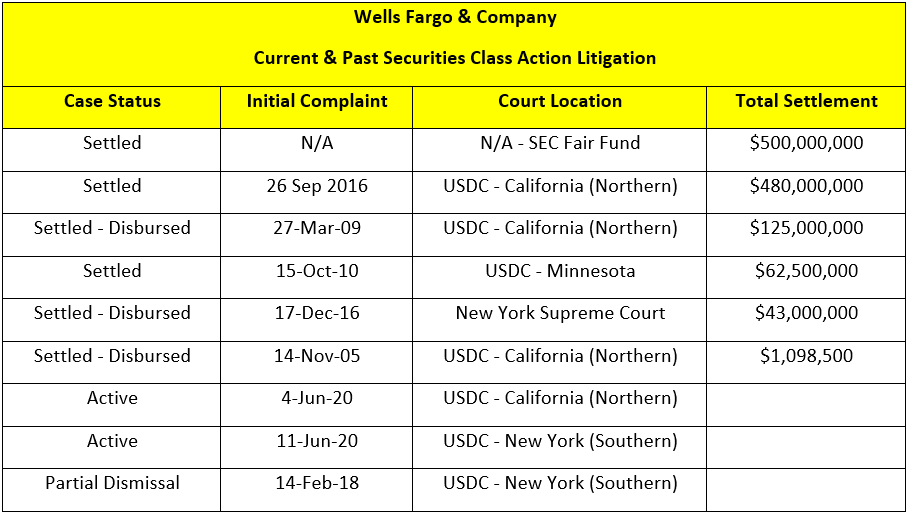

Investors Closer To 500 Million Payout From Wells Fargo Settlement

Wells Fargo Merchant Services Settlement For 40 Million Last Date 23

Wells Fargo Settles Phony Account Securities Suit For 480 Million Wells Fargo Sales Strategy Creation Activities

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement

28m Wells Fargo Settlement Resolves Call Recording Claims Top Class Actions

Wells Fargo To Pay 3 Billion To Doj Sec To Resolve Criminal Civil Charges Tied To Fake Accounts Scandal Cfcs Association Of Certified Financial Crime Specialists

Wells Fargo Mortgage Fee Class Action Settlement Top Class Actions

How To Get Your Piece Of The Wells Fargo Banking Scandal Settlement Bankrate Com

Wells Fargo Account Fraud Scandal Wikiwand

Wells Fargo Customers Won T Be Able To Sue The Bank Over Fake Accounts The Denver Post

Wells Fargo Bankruptcy Credit Reporting 3m Class Action Settlement Top Class Actions

Wells Fargo Agrees To Settle Auto Insurance Suit For 386 Million The New York Times

Wells Fargo Fake Account Lawsuit Settles For 110 Million Fortune

Wells Fargo Paying 3 Billion To Settle U S Case Over Illegal Sales Practices Npr

Wells Fargo Accused In Lawsuit Of Routine Overtime Pay Violations

Wells Fargo Pays 12m For Wrongly Denying Mortgage Modifications Housingwire

Four Settlement Checks In The Mail Top Class Actions

Www Wellsfargocpisettlement Com Class Action Lawsuits Tech Company Logos Wells Fargo